The income tax exemption is effective from January 1 2022 until December 31 2026. No further exemption will be given for the disposal of other private residences.

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Grant or subsidy received from the Federal or State.

. Malaysian income tax law includes the following exemptions and relief. Expatriates may benefit from a special tax regime exemption on their income if the following two conditions are verified. Election for exemption must be made in writing and is irrevocable.

The individual is a Malaysian citizen or Malaysian permanent resident. First not being defined as a fiscal resident. Receiving further education in Malaysia in respect of an award of diploma or higher excluding matriculation preparatory courses.

1 The income of any co-operative society-. Total amount paid by employer. Second if the period of employment in Malaysia does not exceed 60 days per.

Additional exemption of RM8000 disable child age 18 years old and above not married and pursuing diplomas or above qualification in Malaysia bachelor degree or above outside Malaysia in program and in. Exemptions and concessional tax treatment for expatriates Exemptions or concessions are given in certain situations such as. Income from employment exercised in Malaysia for short-term visiting non-resident employees other than public entertainers if the period of employment does not exceed 60 days in a calendar year.

Travelling allowance petrol allowance toll rate up to RM6000 annually. This exemption is no longer applicable to tax residents of Malaysia wef 1 January 2022. Promotion of International Trade Exhibitions in Malaysia Local companies which organise international trade exhibitions in Malaysia will be eligible for tax exemption on income earned from bringing in at least 500 foreign.

The tax exemption is effective from Jan 1 2022 to Dec 31 2026. This applies to an employees immediate family which is defined as their spouse and children. Total amount paid by employer.

KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Article Posted date 07 January 2022. The proposal was enacted into law on 31 December 2021 via the Finance Act 2021 the Act and took effect from 1.

Exemption available up to RM2000 per annum for the following types of award. Exemption is granted for a private residence only. The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and foreign-source dividend income for corporate taxpayers subject to certain conditions.

Medical childcare and dental benefits offered to an individual by their employer. The rental income commencement date starts on the first day the property is rented out whereas the actual rental income itself is assessed on a receipt basis. Foreign income of any person other than a resident company carrying on the business of banking insurance or sea or air transport arising from sources outside Malaysia and remitted into Malaysia.

All classes of income under Section 4 of the Income Tax Act 1967 excluding a source of income from a. The relief is provided in response to the coronavirus COVID-19 pandemic. And b those emoluments are payable from the public funds of that country and subject to foreign tax of that country.

Rental income in Malaysia is taxed on a progressive tax rate from 0 to 30. Child care allowance of up to RM2400 annually. Fees received for providing tutoring or lecturing services in a higher education institution.

The following foreign-sourced income which is brought into Malaysia from 1 January 2022 to 31 December 2026 will remain exempt from Malaysian income tax. Just like Benefits-in-Kind Perquisites are taxable from employment income. However there are exemptions.

Some types of assistance include life insurance medical expenses for parents individual education fees the purchase of a laptop or smartphone. Deleted by Act 328. The MoF has agreed to exempt from tax all FSI derived by resident individual taxpayers except for resident individuals carrying on business through a partnership.

Exemption under Section 8 can only be granted on conditions. A he is in Malaysia for the purpose of performing his duties as a member of those forces or as a person in that service as the case may be. The Chartered Tax Institute of Malaysia has said that the tax exemption on dividends will encourage more investments to be remitted to Malaysia and improve the countrys standing as a destination for regional HQs.

Subject to Inland Revenue Board criteria and guidelines income tax. In such instances tax residents will be exempted from paying personal income tax in Malaysia. In Malaysias Budget 2022 announcement on 29 October 2021 the Government declared that it would remove Malaysias long-standing income tax exemption on FSI received by Malaysian resident corporate 1 and individual taxpayers.

Eligible for tax exemption on income earned from bringing in at least 500 foreign participants per year into the country. Orders on foreign-sourced income have been published in the Malaysian official gazette. Individuals corporates and others will continue to be exempted from income tax under Paragraph 28 Schedule 6 of the Malaysian Income Tax Act.

Long service more than 10 years of employment with the same employer past achievement and service excellence innovation or productivity award. Income tax borne by employer. Tax relief or tax exemption in Malaysia is a system established by the Inland Revenue Board of Malaysia LDHN whereby taxpayers are allowed to deduct a certain amount of money from their income tax.

Subsidies on interest for housing education car loans.

Personal Tax Relief 2021 L Co Accountants

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Income Tax Relief Items For 2020 R Malaysianpf

Malaysia Personal Income Tax Relief 2022

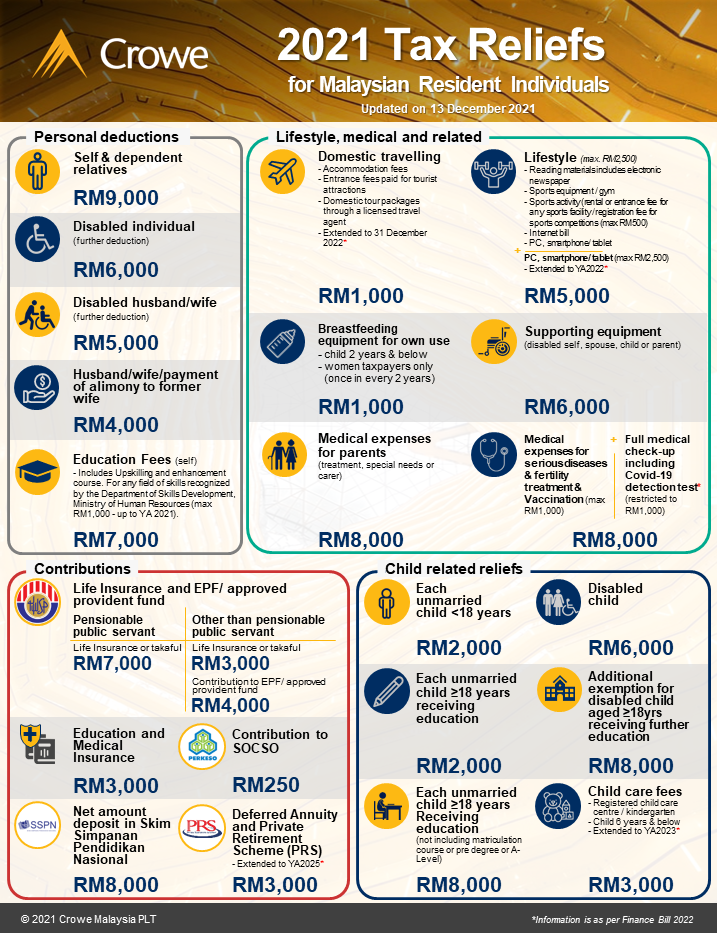

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Lhdn Irb Personal Income Tax Relief 2020

Malaysia Personal Income Tax 2021 Major Changes Youtube

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Special Personal Income Tax Relief Up To Rm 1 000 For Domestic Travels Sunway Travel Sdn Bhd

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Personal Income Tax Guide In Malaysia 2016 Tech Arp

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My